International Trade and Globalisation

In Unit 6 of IGCSE Economics, we will look at how countries specialise, trade, and compete on the world stage, as this is perhaps the most crucial lesson for grasping why some societies prosper while others stagnate.

6.1 International Specialisation

International Specialisation - When countries concentrate on the production of certain goods or services due to their abundance of resources.

Examples: Bangladesh & India → Textiles

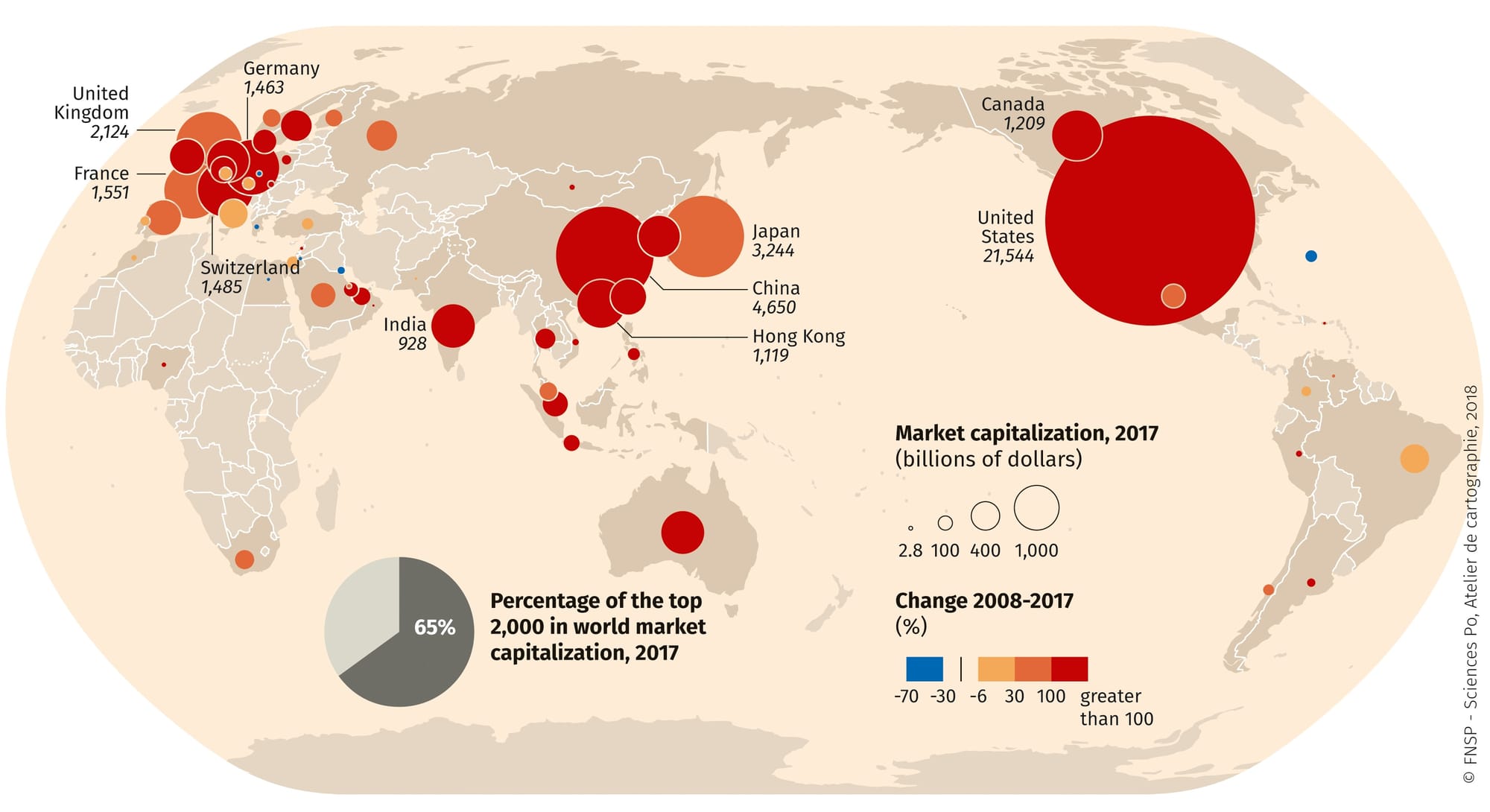

This map shows the total value of exported goods and services for each country with past periodic trends.

Advantages of International Specialisation

| Advantage | Explanation | Real-World Impact |

|---|---|---|

| Efficiency gains | Better use of scarce resources | Countries can produce more with the same inputs |

| Labour Productivity | Workers become better skilled in their jobs, thus output can increase | Skilled textile workers in Bangladesh can produce more garments per hour |

| Increased Productive Capacity | PPC (Production Possibility Curve) shifts to the right | Economy can produce more goods overall |

| Economies of scale | If a nation has a large quantity of x good then they can lower COPs (Costs of Production) and thus produce goods more efficiently | China's massive electronics production reduces per-unit costs |

Disadvantages of International Specialisation

| Disadvantage | Explanation | Real-World Example |

|---|---|---|

| Over-specialisation | Regional & structural unemployment, high risks | Coal production collapse in the U.K. - entire mining communities lost jobs |

| Lack of consumer choice | Standardised mass produced goods, may look at foreign alternatives. Thus reducing competitiveness | When countries only produce one type of good, consumers have limited options |

| High Labour turnover | Due to it being so boring | Repetitive factory work leads to workers frequently quitting |

| Low mobility | Low skilled and poorly paid workers lack the skill to move around | Coal miners couldn't easily transition to other industries |

| High costs | Specialisation leads to higher salaries of the workers | Skilled specialists demand higher wages |

6.2 Globalisation, Free Trade and Protection

Globalisation - Is the economic integration of different countries through increasing freedoms in the cross-border movement of people, goods/services, technology & finance.

Multinational Corporation (MNC) - Is an organisation that operates in two or more countries.

Examples: Apple, Coca-Cola, Samsung

Advantages of MNCs

| Advantage | Explanation | Example |

|---|---|---|

| Job Creation | Improve standards of living | Apple creates jobs in China, Ireland, and many other countries |

| Economies of Scale | Large scale operations, lower labour costs, and per unit costs overall due to setting up in other countries | McDonald's can buy ingredients in bulk globally |

| Profit | Increased customer base, profits may be repatriated (sent back to home country) or may go to offshore accounts | Coca-Cola sells globally but profits return to the US |

| Spread Risks | Favourable conditions in one nation can offset worse conditions elsewhere | McDonald's is able to stay profitable despite the situation in Russia since they have many stores worldwide |

| Avoid trade restrictions | Access to new overseas markets | Setting up factories inside countries avoids import tariffs |

Disadvantages of MNCs

| Disadvantage | Explanation | Real-World Impact |

|---|---|---|

| Unethical practices | Exploitation of workers, environmental damage | Sweatshop conditions in some factories |

| Competition to local firms | Local businesses may be driven out | Small local restaurants competing with McDonald's |

| Exploitation of governments | Taking advantage of weak regulations | Some MNCs avoid paying fair taxes |

| Diseconomies of scale | Time zones, legal issues, communication problems | Coordinating operations across different countries is complex |

| Exchange rate fluctuations | Can change costs and revenues | A stronger dollar makes US exports more expensive |

| Culture & Trends | May be at a disadvantage if they sell goods that aren't liked in other countries | McDonald's had to adapt its menu for India (no beef) |

International Trade Concepts

International Trade - Refers to the exchange of goods and services beyond national borders.

Free trade - International trade takes place without protectionist measures (no embargoes, quotas, or taxes).

Protection - Refers to the use of trade barriers to restrain foreign trade, thereby limiting overseas competition.

Types of Trade Protection

| Protection Method | Definition | Impact on Government | Impact on Firms & Consumers |

|---|---|---|---|

| Tariff | Tax on imports which increases production costs for firms | Tax Revenue for Government | Higher Costs for FIRMS & CONSUMERS; AD SHIFTS LEFT |

| Import Quota | Quantitative limit on the sale of a foreign good | Controls quantity of imports | Limited supply, higher prices |

| Subsidies | Form of government financial assistance to help cut production costs of domestic firms, enabling them to compete against foreign producers | Government spending increases | Domestic firms become more competitive |

| Embargo | Ban on trade with a certain country | Political tool | Complete loss of that market |

Arguments FOR Protection vs AGAINST Protection

| FOR PROTECTION | AGAINST PROTECTION |

|---|---|

| Infant industries - Small companies need protection to grow | Distortion of market signals - Misallocation of resources |

| Domestic jobs - Protect local employment | Increased COPs - Higher costs of production |

| Dumping - Prevent unfair foreign competition | Retaliation - Other countries may impose their own barriers |

| Government revenue - Tariffs provide income | |

| BOP deficit - Reduce imports to overcome balance of payments problems | |

| Strategic - Reduce dependency on foreign suppliers |

6.3 Foreign Exchange Rates

Exchange rate - Refers to the price of one currency measured in terms of other currencies.

Example: £1 = 100 INR

It is a part of monetary policy, and is enacted by the Central Bank (RBI in India, BoE in UK, Federal Reserve in USA).

Foreign exchange market - Market place where different currencies can be bought and sold.

Key Terms

- Appreciation - Increase in value relative to another currency in the floating exchange rate system

- Depreciation - Fall in value relative to another currency in the floating exchange rate system

General Overview of Theory:

If £ appreciates (goes up):

- Imports become cheaper

- Exports become less competitive (for other countries)

If £ depreciates (goes down):

- Imports become expensive

- Exports become more competitive

Key Formula: £↑ = X↓ + M↑ (If pound goes up, exports go down, imports go up)

Types of Exchange Rate Systems

| System Type | Definition | Examples | Government Role |

|---|---|---|---|

| Floating exchange rates | Currency is allowed to fluctuate against other currencies according to market forces, without any intervention | India, U.S.A | No intervention |

| Fixed exchange rates | Government intervenes in foreign exchange markets to maintain the rate at a predetermined level (PEG) | Some developing countries | Active intervention |

Peg parity - When one currency equals another, e.g., if $1 = £1

- Devaluation - Price of currency operating in a fixed exchange system is lowered

- Revaluation - Price of currency operating in a fixed exchange system is increased

Causes of Exchange Rate Changes

- Changes in demand for exports/imports

- General Price Level (GPL) & Inflation

- FDI (Foreign Direct Investment)

- Speculation - Variations in exchange rates for profit (Hot money)

- Government intervention

Consequences of Exchange Rate Fluctuations

| Affected Group | Impact |

|---|---|

| Customers | Purchasing power changes |

| Exporters and Importers | Costs and revenues change |

| BOP | Appreciation = worse trade balance (vice versa) |

| Employment | Export industries affected |

| Inflation | Lower spending = lower inflation |

| Economic growth | Strong currency can hurt growth |

Coping Strategies

- Cutting export prices

- Finding alternative suppliers

- Improved efficiency

- Focus on inelastic goods (goods people must buy regardless of price)

6.4 Current Account BoP (Balance of Payments)

Balance of payments (BoP) - Financial record of a country's transactions with the rest of the world for a given time period.

Current account - Records of exports and imports of goods and services + net income transfers.

Parts of the BOP

| Component | What it includes | Examples |

|---|---|---|

| Trade | ||

| - Visible Exports/Imports | Goods | Cars, oil, machinery |

| - Invisible Exports/Imports | Services | Tourism, banking, insurance |

| Primary Income | ||

| - Net income from investments abroad | Money earned from owning foreign assets | Dividends from foreign companies |

| - Profits earned by subsidising an overseas firm | Money from foreign subsidiaries | Apple's profits from iPhone sales in China |

| - Money sent home from people working abroad | Worker remittances | Indian workers in Dubai sending money home |

| Secondary Income | ||

| - Net income transfers | ||

| - Donations to charities abroad | Aid and charitable giving | Oxfam donations to Africa |

| - Foreign aid | Government assistance | UK aid to developing countries |

| - Subsidies or grants | Government transfers | EU grants to member countries |

Formula: Current Account = Balance of Trade + Primary Income + Secondary Income

BoP Imbalances

Deficit BoP - Spending > Income (More imports)

- Lower demand for exports (too expensive, bad quality, protection)

- Higher demand for imports domestically

Surplus BoP - Spending < Income (More exports)

Consequences of Deficits

- Reduced demand for domestic goods

- Unemployment - Cyclical unemployment and wage cuts

- Lower standard of living

- Increased borrowing from other countries

- Lower exchange rate

Consequences of Surpluses

- Employment - Due to higher exports creating jobs

- Standards of living - Higher income thus can create better standard of living

- Inflationary pressures - Higher demand for exports can lead to demand-pull inflation. They may diminish international competitiveness

- Higher exchange rates - Imports become cheaper (Dutch Disease - when a country's currency becomes too strong)

BoP Stability Policies

| Policy Type | Method | How it Works |

|---|---|---|

| Fiscal Policy | Increase Taxes | Reduced spending on imports |

| Monetary Policy | Increase Interest Rates | Reduced spending on imports |

| Supply-side Policy | Increase productive capacity (Education, training, etc.) | Make domestic goods more competitive |

| Protectionist measures | Tariffs, quotas, etc. | Reduce imports directly |

Expenditure switching policies - Protection measures that encourage people to buy domestic instead of foreign goods

Expenditure reducing policies - Monetary policy and fiscal policy that reduce overall spending, including on imports

Quiz Time!

International Trade and Globalisation Quiz

Test your knowledge and master the concepts! 🌍

This is the end of this revision guide. It is also the end of all units covered in IGCSE Economics! You deserve a pat on the back!

Thank you for using IGCSE Pro. We hope to see you again!